Tl;dr

On 2nd August, 2021, the Prime Minister launched the E-Rupi voucher programme. Given that these vouchers are supposed to revolutionise India’s digital payments system and even assist in the delivery of COVID-19 vaccinations, we thought we’d create an explainer on the scheme. This explainer is our attempt at helping people understand the nature of the programme and also explaining the attendant concerns that arise from the use of such schemes.

What is the E-Rupi?

The E-Rupi is a digital payment instrument developed by the National Payments Corporation of India (NPCI) with the help of the Department of Financial Services (DFS) and the National Health Authority (NHA). Essentially, it is a pre-paid digital voucher that will be received in the form of an SMS or a QR code. The cashless nature of the E-Rupi is designed to help beneficiaries use the voucher in the absence of cards, digital payments apps, or access to the internet.

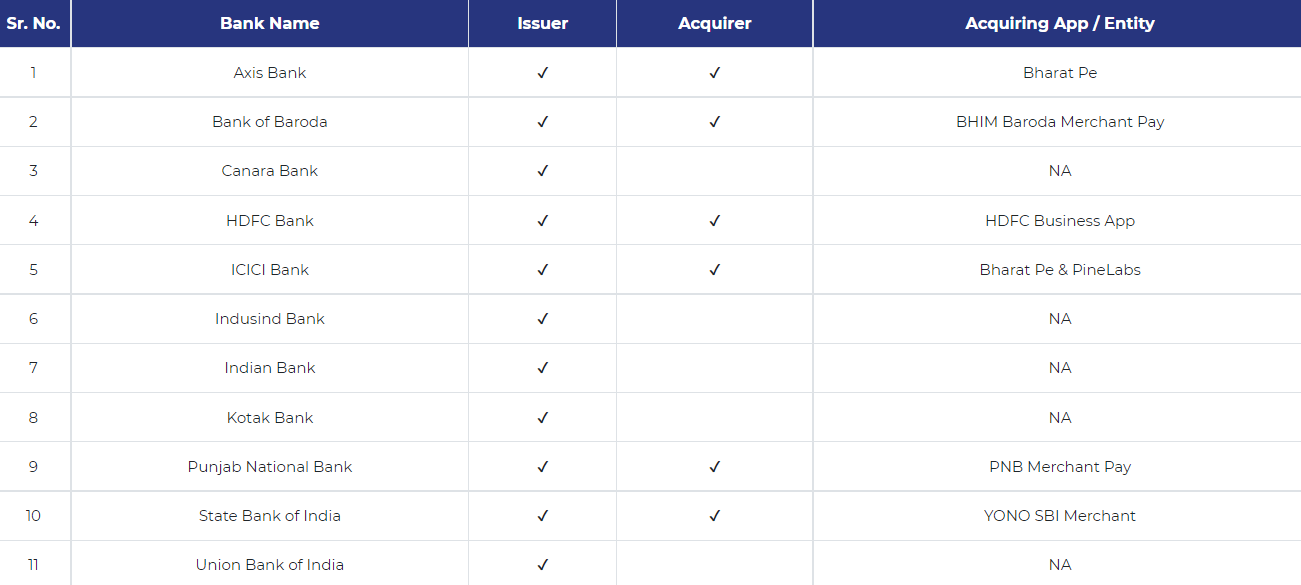

At present, E-Rupi vouchers will be used to help with the government’s COVID-19 vaccination rollout. At present, according to the NPCI, 11 major national banks can issue E-Rupi vouchers and 1641 hospitals are currently accepting E-Rupi vouchers as payment.

However, further use-cases of E-Rupi have also been contemplated:

- Beyond COVID-19 vaccines, the healthcare sector can use it to provide medicines and nutritional support.

- Direct Benefit Transfers for income support from the government can also be delivered through E-Rupi vouchers.

- E-Rupi vouchers can be used to facilitate school voucher programs.

- Private sector enterprises can use it to deliver welfare benefits to employees.

- MSMEs can use it for business to business transactions.

- Subsidies for fertilisers, fuel etc may be delivered through E-Rupi vouchers.

What are the proposed benefits of the E-Rupi?

Advocates of the E-Rupi claim that given the design of the E-Rupi, it can be used by anyone with a basic phone without an internet connection. This will also help speed up the move towards a cashless economy, as the voucher will be redeemed simply by scanning a QR code or an SMS. Given that E-Rupi is a prepaid instrument, transaction times are also supposed to decrease.

Additionally, recipients of the E-Rupi do not need to have a bank account, which supporters say will lead to greater adoption in the mofussils, where banking coverage is lower. The cashless form of the voucher is also supposed to lead to reduced payment costs, which may also lead to better working capital management and increased liquidity. Lastly, the targeted and transparent delivery of welfare benefits through the E-Rupi are proposed to help reduce leakages in government schemes.

What is the public saying about the programme?

The programme has been met with enthusiasm by cryptocurrency aficionados and the larger fintech ecosystem, who believe that the program will spur a revolution in the digital currency environment in India and transform the existing digital payments landscape. They believe that the E-Rupi will democratise and decentralise the payments system, bringing those without bank accounts into the fold of the banking system.

Others have spoken about the potential gains in efficiency, transparency, and accountability: R.S. Sharma and Ashok Pal Singh have pointed of the various use cases of the E-RUPI said that:

“Light regulation and the opening of e-RUPI to competition will spur innovation and adoption.... e-RUPI opens up a world of opportunities to the government, people, and businesses to provide, avail and pay for services seamlessly.”

However, others have pointed out concerns related to financial surveillance and possible exclusion. Given that the E-Rupi voucher purportedly hides information about the beneficiary, critics say that it is possible that people may start making claims on others E-Rupi vouchers and redeem other people’s vouchers through fraud. Additionally, they say even if the voucher supposedly hides the identity of the beneficiary, a lot of other data is automatically embedded into the voucher that may be sensitive information.

What are the main issues with the E-Rupi?

One of the main concerns about the E-Rupi programme is the threat of the exploitation of the data generated by the usage of E-Rupi vouchers. These concerns centre broadly around two key broad themes: financial surveillance by governments and financial exploitation by private entities. The former stems from the fact that, unlike a physical coupon, the e-Rupi voucher is a person specific instrument. Thus, even if this is not by design, some information about the beneficiary will automatically be given out over the course of its use.

Such concerns about privacy have also been raised by academics, who noted that designing a framework that can “confirm the identity of the issuer, ensure the authenticity of the e-voucher, and achieve non-anonymity and non-transferability”, though possible, requires a complex system with strict controls of the flow of information which presently does not exist. In the absence of such controls, granular and disaggregated data about citizens may be used for surveillance by the state. At present, India does not have robust data protection legislation, while many of the supporters of the programme have spoken about the need for light touch regulation with respect to E-Rupi vouchers. In such a context, fears about data harvesting and exploitation cannot be ignored.

Financial exploitation through fraud and predatory behaviour is also a danger. This can be evidenced from earlier instances where similar heedless digitalisations have happened in the field of welfare. For example, the PM-KISAN scheme witnessed Rs. 110 crore being credited to those who were not beneficiaries due to factors such as the deregulation of norms. Additionally, LPG payments that were being delivered through the Airtel Payments bank were not delivered to the bank accounts of beneficiaries and instead went into their Airtel bank accounts, a lot of which were automatically created without user consent. Such happenings not only necessitate the need to spend government resources on the recovery of the money disbursed but also effectively take away benefits from genuine beneficiaries.

Lastly, while supporters of the programme tout its design as one that will increase inclusion into the formal financial system, this may be accompanied by significant exclusion from welfare benefits. This is because the E-Rupi will make the ownership of a phone necessary for the receipt of welfare services. India still witnesses a significant digital divide, as can be seen from the latest data from the Telecom Regulatory Authority of India: as of 31st May, 2021, overall teledensity is 87.84%, while rural teledensity is even lower 60.22%. Given that those in rural areas will be a large percentage of the intended recipients of the welfare benefits, a reliance on E-Rupi vouchers may result in the exclusion of those who need it the most.

We have already witnessed such exclusion with Aadhaar-based authentication for PDS entitlements, where a study in Jharkhand also found that Aadhaar based verification “either did not reduce errors of inclusion or leakage or did so at the cost of increased exclusion error”, with an error of between 22% and 34% of reduced disbursals. Furthermore, the study found that 88% of the ration cards that had been cancelled in the name of addressing leakages actually belonged to genuine citizens of India!

Our recommendations

In light of the above issues, we have the following recommendations:

- Need for consultation and discussion: The E-Rupi programme will introduce massive changes into not only India’s digital payments system but also our welfare delivery framework. Such changes will impact the lives of millions of India, especially those dependent on welfare benefits, and so they require significant consultation before they can be implemented. Thus, we recommend that the DFS puts out a white paper on the E-Rupi scheme, after which it begins a publicly notified consultation process, drawing on perspectives not just from the financial sector but also civil society, technical experts, and academics.

- Security standards for data generated from E-Rupi usage: In the absence of robust data protection legislation, the massive amounts of data that will be generated from the usage of E-Rupi vouchers will be vulnerable to exploitation. Thus, in case the E-Rupi programme is to be implemented in the absence of such a law, it is important security standards for the storage and processing of E-Rupi data be specified, including guidelines for strict access controls.

Important Documents

- IFF’s blogpost titled ‘#DataProtectionTop10: State Security and Surveillance’ dated 25th May, 2021 (link)