UPDATE 08.12.2018 : TRAI extends the submission guideline by a month. New Date for submissions is now 07.01.2019. Counter comments is 21.

One of the core questions in the ongoing OTT consultation paper floated by the TRAI are the revenue losses by large telecom companies which would impair future telecom network investment. There has always been an underlying sentiment in such conversations on placing the blame on internet platforms and services that somehow have stolen profits from telecom companies by voice calling and instant messaging services. This builds into arguments for levying some form of a toll to "compensate" telecos for their losses.

We examine multiple strands of this argument on the basis of financial data to examine whether there is any truth to this. Has a growth in the use of online calling and messaging hurt telecom revenues in India?

Data sheet of Telco Financials

We first invite you to view a data sheet broken across quarters that maps the financials of the sector based of TRAI data, and three large telecom companies, Airtel, Idea and Reliance Jio.

- Link to the financial spreadsheet available over at Google Sheets

- You can also read our summary and an analysis of the OTT Consultation Paper over here.

A preliminary analysis

We call this a preliminary analysis because this requires inputs and peer review. We encourage you to send any thoughts or comments you may have on this to [email protected]. All of this will be considered in our final submission to the TRAI. From our knowledge and understanding, such an exercise has not yet been done in the consultation paper, or is publicly available. Even though we have taken care in our number crunching, we would appreciate financial and telecom experts to weigh in.

Growth in use of both voice and data across the sector

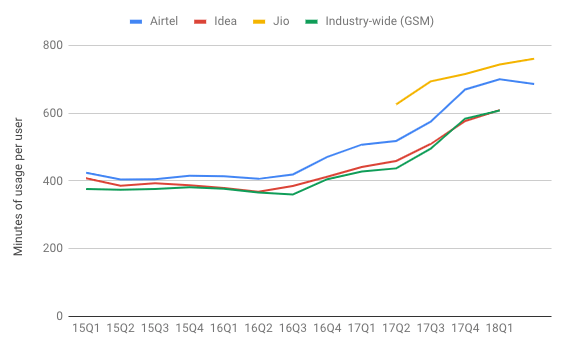

Let us first start with the basics. What have been the growth trends in voice and data use across operators? Both voice and data usage have seen a significant increase in the past few years. The sharp rise also coincides with the launch of Jio---as an example, industry-wide voice usage saw a 2% year-on-year fall in 16Q2, but since then has increased by 166% (Graph 1).

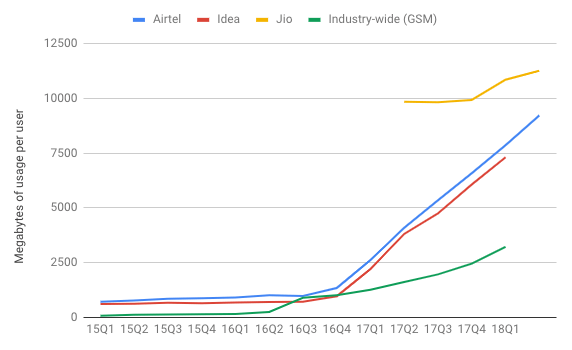

Also, the growth of data usage has been spectacular. Again this sharp rise has been since 16Q2 which is when Reliance Jio has launched services. Do notice this is against all teleco operators as is also evident from TRAI data which shows an increasing rate of quarter on quarter growth (Graph 2).

Is there financial stress in the Telecom Sector?

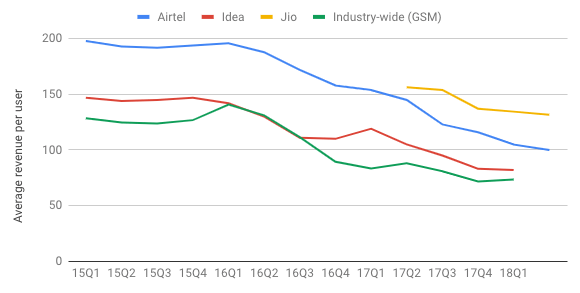

There are two core metrics to understand revenue and profitability in the telecom industry. The first is ARPU (average revenue per user) defined as the total revenue divided by the number of subscribers. Three graphs below give the aggregate ARPU for all services provided by Telecos (Graph 3).

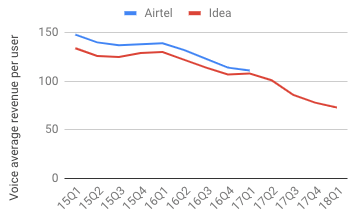

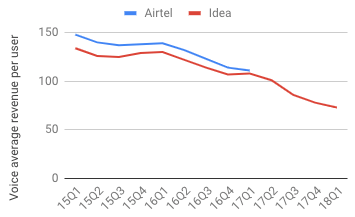

We have sub-divided into VARPU (voice average revenue per user in Graph 4) and DARPU (data average revenue per user in Graph 5).

It is again important to consider that the numbers change drastically after Jio’s launch in 16Q2. Industry-wide ARPU saw a year-on-year increase of 5% for 16Q2, a quarterly decline of 15% by 16Q3, and a year-on-year 33% decline for 17Q2.

The same trends can be seen in data and voice ARPU, which were relatively stable until 16Q2 and then saw a precipitous fall. Airtel stopped disclosing both in their quarterly reports in 17Q2.

The fall (quarter-on-quarter, of 15% for Airtel and 14% for Idea) in 17Q3 is to a large extent attributable to TRAI reducing the interconnect usage charges from 14 paisa to 6 paisa. In their quarterly reports, Airtel says this accounts for an 11% fall in ARPU.

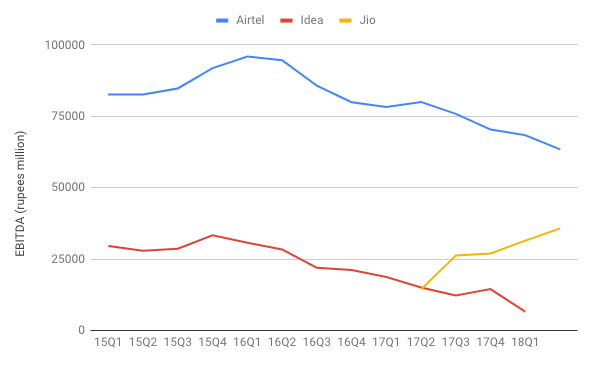

The second metric to measure the health of telecom firms is EBITDA. Earnings before interest, tax, depreciation and amortisation (EBITDA) is a measure of a company's operating performance. Essentially, it's a way to evaluate a company's performance without having to factor in financing decisions, accounting decisions or tax environments. We have set this out in Graph No. 6 below.

As with everything prior, there is a noticeable change in trends around 16Q2 (when telcos started aggressively pricing their plans and providing unlimited voice bundles with data plans). As with ARPU, the fall (quarter-on-quarter, of 11% for Airtel and 19% for Idea) in 17Q3 is to a large extent attributable to the reduction in the interconnect usage charges. In their quarterly reports, Airtel says this accounts for a 4% fall in EBITDA, while Idea says this accounts for a 15% fall in EBITDA.

What is the amount of money necessary for network investment and upgradation?

This is another aspect where not a lot of data exists publicly. We only have some estimates to proceed on how much money will be necessary and how it will be used. This is the tricky part, as it is part projections... proceeding on multiple variables without access to proper and full data.

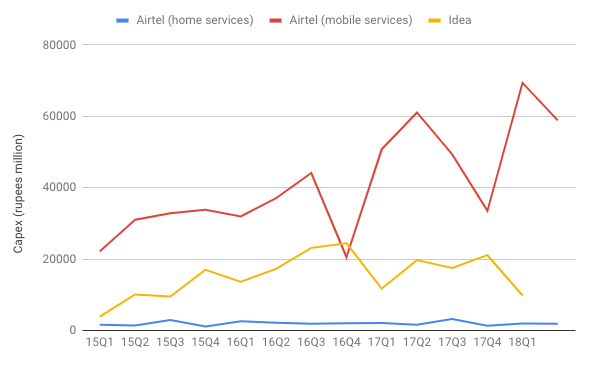

The only rough estimate we could find was to just use the capex (capital expenditure) figures of telecom companies from the quarterly reports (See Graph 7). Even this is not clear as to how much goes towards building data networks. For instance the Idea reports here at least explicitly say that "the majority of this goes towards 4G expansion".

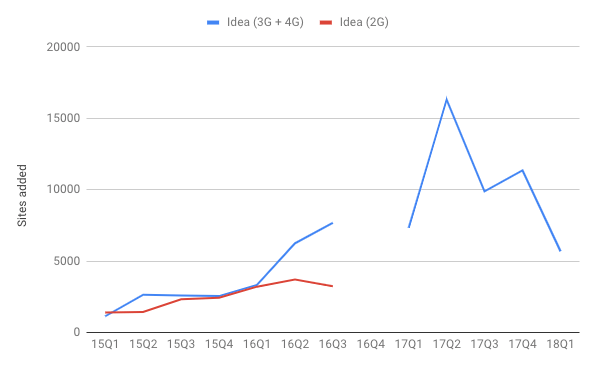

Idea also reports the number of 2G and 3G+4G cell sites they added that quarter. This is also graphed up (See Graph 8). We acknowledge that, it's hard to get a more specific picture, but then if there is an actual need for investment, a clear, public statement with data should be made.

At the same time there are other independent programs specific to telecom players such as Airtel's Project Leap announced in 2016 with a plan for an investment of 600,000 million rupees over the next three years. So far the gross capex is Rs. 387,546 mil, and a year's left. Airtel also has a capex forecast of Rs. 250,000 mil for this year of which it is roughly halfway there at Rs. 128,213 mil. Vodafone Idea (not just Idea -- the merged entity) has a capex guidance for Rs. 270,000 mil for the next year.

So whats the verdict?

Three preliminary inferences can be made from the data:

- Massive growth post 16Q2: Both voice calling and data use are growing across the sector. This explodes after 16Q2 which is when Reliance Jio starts services. The rate of growth is increasing and more people are coming online.

- Fall in average rate per user: This massive growth has coincided with a drop in per user revenue for the major telecom players. Such fall appears to be due to a hyper-competitive environment after the entry of Reliance Jio, however with a wave of consolidation this period may soon end. Such trends are as per statements in the press by leading executives of telecom companies and analyst reports such as Moody's and Fitch.

- Ambiguity in the amount of investment: While there is a need for continued investment, we do not know to what extent, to what number and in what period of time. The data here is spotty and while the number may be large to devise any public policy measure there needs to be evidence.

What the data also discloses is that we cannot keep blaming increased data use for a fall in profitability for telecom companies any longer. Statements by major telecom companies usually attribute multiple correlations, but the overwhelming consensus is hyper-competition. As per analyst reports this is slated to end sometime next year (latest by QY20) when the sector enters a period of consolidation given that only three major telecom companies will exist (Airtel, Idea-Voda, Reliance Jio).

We hold a preliminary view that devising regulations to place regulatory burdens or financial levies on internet platforms and services by itself is not a sound public policy measure from the perspective of data. The objective of regulation should not be to protect the profits of companies, it should be to serve public welfare. For our more analytical overview of the TRAI paper we invite you to read an analysis that we published yesterday.

IFF would like to thank Shikhin who has volunteered for all this complex number crunching and inputting into this financial snapshot to help us out. You can also volunteer to and become a part of a standing force that fights for the free and open internet. Send us an email today over at [email protected]

About us

- Work: The Internet Freedom Foundation (IFF) is an indian civil liberties organisation working on technology and fundamental rights. We work across a wide spectrum, with expertise in free speech, digital surveillance and privacy, net neutrality and innovation to champion of freedom in the digital space. To ensure that people in the world's largest democracy use the internet with liberty guaranteed under the Constitution of India.

- Transparency: We are a non-profit registered under Section 80G of the Income Tax Act. Aimed towards greater accountability to our donors who are ordinary internet users in India like you we have published detailed financial information that is updated regularly.

IFF Online:

- Email: [email protected] and [email protected]

- Website: https://internetfreedom.in/

- Twitter: @internetfreedom

- Facebook: https://www.facebook.com/internetfreedom.in/